Home ownership in Kenya is one goal that appears in the goal form of many, every single year. The excitement of having a roof over your head without the headache of paying rent monthly is huge.

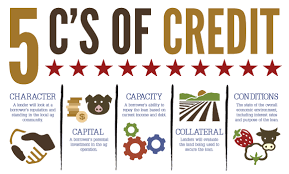

The two options of home ownership in Kenya using a credit facility is either a construction loan or a mortgage. Whichever option you go for, you will need to engage with your bank or other lending institution for financing. This is where the 5 C’s of credit need to become a reality. These are the 5 factors that all lending institutions use to asses their clients and decide whether or not to extend a credit facility to them.

- Character

Every lending institution is looking to lend money to people or institutions with sound character. Character is extremely important and helps to point out a client who will actually be keen to meet his financial obligation. One who has no past reputation of being dodgy or involved in any under hand, shoddy deals.

Character has everything to do with the first impression that you make on the lender, as well as your reputation. The lender will be keen to speak to those who have worked with you in the past to figure out just what kind of person you are.

- Capacity

You may be interested in borrowing money but are you actually capable of paying it back as agreed? The lender you are working with will be keen to know all your financial obligations, present and future as well as your cash inflows to determine if you are in a position to take on the financial obligation of paying for a loan. This is called a debt to income ratio. The lending institution will shy away from lending money to someone whose current obligations are more than their current cash flows for obvious reasons.

- Capital

Capital basically refers to your net worth, either as an individual or as a business. This is simply the difference between what you own versus what you owe. The lender wants to know that should something go wrong, affecting your cash flows, you can use your assets to service your obligations. If you are a business owner, the lender will consider how much you have invested in your business as capital. The rule of thumb is those who invest more work harder and are more likely to succeed than those who have invested little.

- Collateral

Collateral refers to assets that you present to the bank as surety and it basically gives the lending institution a fall-back position or a plan B should you be unable to service the loan. Assets such as cars, houses, land, fixed deposit accounts etc. are commonly used as collateral. Some institutions will take it a step further and ask forba guarantee in addition to collateral, especially when risk is deemed to be high. A guarantee is an undertaking by a third party to underwrite a loan should the borrower fail to pay the loan.

- Condition

Condition refers to the macro and micro economic environment that can have a direct or indirect impact on your cash flow, thus hampering your ability to service your obligations. These conditions are usually beyond your control. If you are a business owner, the lender will consider your industry and the factors that can affect your business as well as the health of your business before lending to you.

If you wish to borrow money for your home construction or mortgage, it is important for you to do a self-evaluation in line with these 5 C’s and ensure that you score highly. This will increase the chances of a lender considering your application and get you that much closer to your dream of home ownership.

[…] is good to keep in mind the 5 C’s of credit when seeking a real estate development loan. These are Character, Capacity, Capital, Collateral and […]